In an economy where the only certainty is uncertainty, knowledge is the only sure source of lasting competitive advantage and value, writes Ikujiro Nonaka in the Harvard Review.

He identifies that successful companies are those that consistently create knowledge, disseminate it widely through the organisation and quickly embody it in new technologies and products.

Dr Valerie Lynch, CEO of ANDtr, saw potential to apply Nonaka’s insights to an intractable challenge faced by Innovation and R&D Managers – how to assess the value of innovation using non-financial measures.

![Dr Valerie Lynch awarded life-time achievement award for her contribution to electronics [credit: Electronics Weekly] Dr Valerie Lynch awarded life-time achievement award for her contribution to electronics [credit: Electronics Weekly]](https://www.rndtoday.co.uk/wp-content/uploads/2024/05/Valerie-Lynch-lifetime-achievement-award-feat.jpg)

Innovation as knowledge creation

Unlike the Western approach, where the only ‘useful’ knowledge is that which can be codified, Nonaka explains that successful Japanese firms such as Honda, Canon, NEC, have an alternative way to managing the creation of new knowledge and this has enabled them to respond quickly to customers, create new markets and dominate emergent technologies.

Nonaka makes a distinction between “tacit” knowledge – the valuable and subjective insights and intuitions that experts carry in their heads and that are difficult to capture and share, and “explicit” knowledge that is objective and transferable.

He identifies that ‘knowledge-creating’ companies are those that are able to distil explicit knowledge from tacit knowledge for new product development, and to keep developing tacit knowledge to ensure continuous innovation.

Financial metrics alone are unable to quantify knowledge-gained

In her paper: “Emerging technologies preserving and growing value over multiple innovation timelines Valerie Lynch identifies a universal challenge for innovation managers.

“The time lag between value generation and value capture can be considerable for emerging technologies. For those where market maturity is yet to be reached financial indicators may not be available. Therefore an alternative to financial measures is needed to inform decision making on further investment,” she observes.

“This conundrum, is captured by Nonaka in his case-study of Mazda, he described how the development required multiple innovation timelines before the technology reached market. If financial measures had been the sole criteria for continued investment, the project would most likely have been stopped.

“Instead, Mazda assessed the knowledge, and know-how created, against alignment with its strategic purpose, this process recognised that knowledge is a key resource in the company and innovation had created value.”

Market Value is future looking

Understanding the potential for the company to use its resources and assets to create future value is important not only for investors but also for all shareholders and the company itself. This is captured in the concept of Market Value.

Whereas Book Value of the equity or assets held by a company is a lagging financial indicator, Market Value represents the owners’ perception of the future potential of the company. For publicly traded companies, Market Value is calculated using the current share price – which is a measure of the confidence of investors in a company.

Some analysts use a combination of Book Value (lagging) and Market Value (leading) to create a ratio that indicates how effectively the company is using its resources. This is particularly effective if the company is investing in innovation.

It is also widely acknowledged that other factors – such as consumer confidence or ambitions towards Net Zero – can also add value to an organisation, and these elements can be reported alongside the financial results.

However, this dialogue is less well developed for the innovation process.

Valuing innovation with non-financial metrics

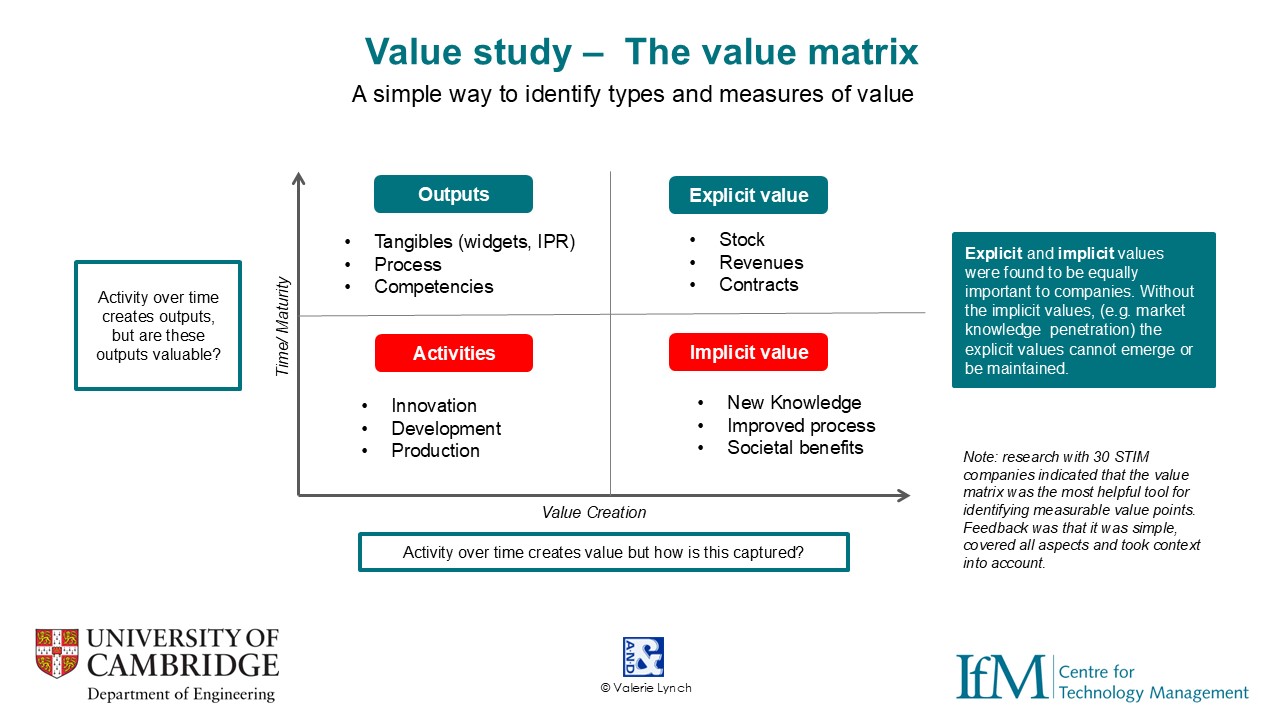

In a study with members of the Strategic Technology & Innovation Management (STIM) programme, hosted by the Cambridge-based Institute for Manufacturing (IfM) it was found that companies struggled to capture tacit, also described as implicit, knowledge created over multiple timelines as it was difficult to articulate.

Valerie continues: “The problem facing companies is that without recourse to financial metrics they needed to create a narrative to describe the knowledge gained and its impact and they lacked a consistent language to do this.”

To address this a ‘value process’ was developed by the researchers with specific terms:

- explicit – knowledge that is objective, recorded and shared

- explicit value can be articulated through impact on financial indicators

- implicit – knowledge that is subjective and held by individuals

- implicit value needs to be captured through narrative

- enrichments – skills and knowledge created over time through successive innovation cycles

- headstart – the impact of enrichments on level of innovation achieved on start of subsequent innovation work

Valerie explains: “My definition of implicit encompasses more than knowledge. I deliberately don’t use tacit because it implies that the value is held passively only as knowledge.

“The term ‘enrichment’ is selected as it reflects the need for value. If a new process developed during an innovation cycle is not aligned with the strategy, it will not impart value and therefore won’t contribute to enrichment.

“Other research has looked at knowledge-based work, which tends to focus on the link between the tacit knowledge and the explicit measures at the company level. My interest is on how to measure and capture value at the project level either as it is happening or as a study of the project level data.”

Value matrix

Value process audit

The research was in two parts – the value process was first introduced and used by the company and then secondly, the ease of use and effectiveness was audited.

Following use of the value process, 88% of companies could articulate how innovation had added value. This showed that the process had made it possible to capture the data required to demonstrate value created.

More reading

Read the full paper: Emerging technologies preserving and growing value over multiple innovation timelines

Further reading:

- M. Christensen, Clayton & Suarez, Fernando & Fernando, Fumagalli & Utterback, James & M, James. (1996). Strategies for Survival in Fast-Changing Industries. Management Science. 44. 10.1287/mnsc.44.12.S207.

- V. Thorn, F. Hunt, R. Mitchell, D. Probert & R Phaal (2011). Internal technology valuation: real world issues. Int. J. Technology Management, Vol. 53, Nos. 2/3/4, 2011.

- V. Lynch (2013). An investigation into the value of embedded software. University of Cambridge PhD Thesis. Feb. 2013.

- R.Mitchell, R. Phaal, N.Athanassopoulou (2018). Scoring methods for evaluating and selecting early stage technology and innovation projects. Centre for Technology Management working paper series ISSN 2058-8887, No. 2 March 2018.

- I. Chandrasekar. (Nov. 2018). DRIVING DISRUPTION:Catching the Next Wave of Growth in Electric Vehicles.

- Porter, M., (1985). Competitive Advantage: Creating and Sustaining Superior Performance. The Free Press.

- Porter, M. (1979). How Competitive Forces Shape Strategy. Harvard Business Review , 57 (2 March-April),pp.137-145.

- Grundy, T. (2006). Rethinking and reinventing Michael Porter’s five forces model. Strategic Change,15(5), pp.213-229.

- Pindado, J., de Queiroz, V., de la Torre, C., (2010 ). How Do Firm Characteristics Influence the relationship between R&D and Firm Value. Financial Management,pp.757-783

- Sorescu, A., Spanjol, J., (2008). Innovation’s Effect on Firm Value and Risk: Insights from Consumer Packaged Goods. Journal of Marketing,72 (March),pp.114-132.

- Srinivasan, S., Hanssens, D., (2009). Marketing and Firm Value: Metrics, Methods, Findings, and Future Directions. Journal of Marketing, 46(3),pp.293-312.

Ikujiro Nonaka is a Japanese organizational theorist and Professor Emeritus at the Graduate School of International Corporate Strategy of the Hitotsubashi University, best known for his study of knowledge management.

- Nonaka, Ikujiro (1991), “The Knowledge-Creating Company”, Harvard Business Review, 69 (6 Nov-Dec): 96–104